Explore

Cryptocurrency News

Analysis

BREAKING: Bitcoin’s Value Drops Below $69,000 – What Triggered the Decline? Details Here…

BREAKING: Bitcoin’s Value Drops Below $69,000 – What Triggered the Decline? Here’s the Liquidation Data

The sudden drop in the value of all cryptocurrencies, led by Bitcoin, has sparked discussions in the crypto market. What could be the reason behind this decline?

Author:

Mete Demiralp

07.06.2024 – 18:31

Update:

1 hour ago

0

Following a sudden decline, the price of Bitcoin (BTC) experienced a 3% loss in just minutes, dropping to $68,500 at its lowest point.

It is believed that the decline may have been triggered by a live session conducted by RoaringKitty, a prominent influencer in the GameStop stock community. This live broadcast, followed by around half a million viewers, was also aired on major financial channels like CNBC.

During RoaringKitty’s broadcast, GameStop stocks plummeted, causing the influencer to lose a total of $235 million. These stocks are often likened to memecoins in the cryptocurrency world.

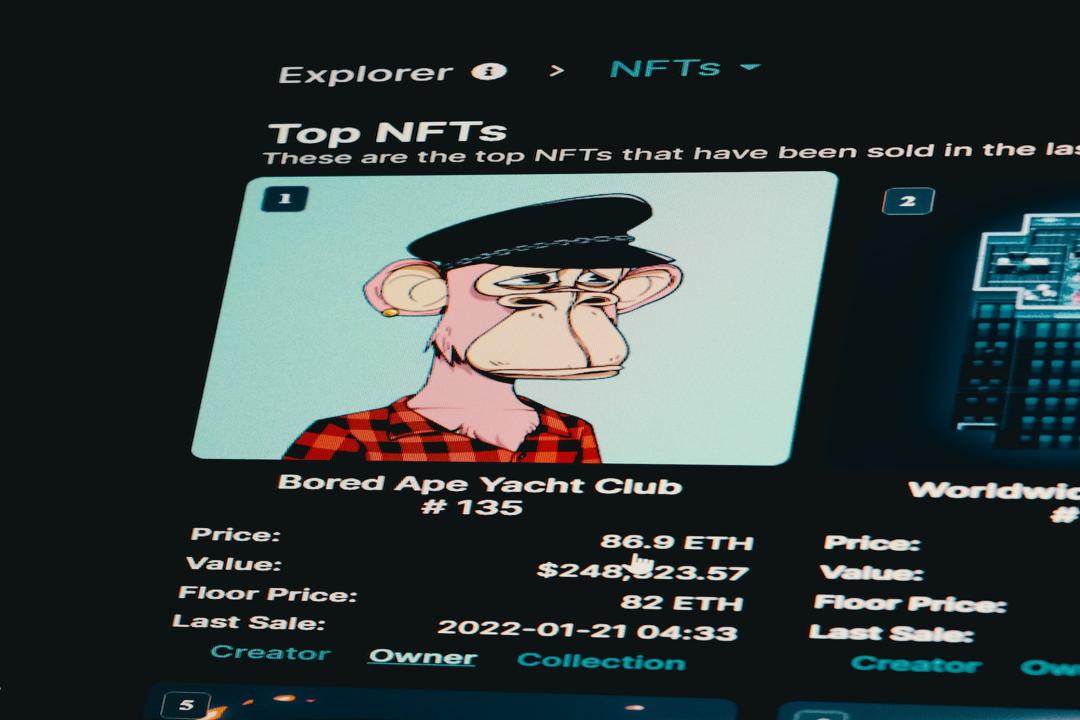

Additionally, data indicates that there has been a significant liquidation of approximately $300 million in the crypto market within the past hour. Out of this total, $285 million comes from long positions, with the remainder from short positions. Notably, a substantial portion of these liquidations involve other altcoins such as Bitcoin, Ethereum, Dogecoin, and Solana.

The table above illustrates the liquidations that occurred in the past hour.

It is speculated that the majority of liquidations targeted low-market-value memecoins.

The liquidation amount for Bitcoin is relatively modest at $44 million.

*Please note that this is not investment advice.

For access to over 300 cryptocurrencies, you can sign up with Binance exchange using this link and enjoy a 20% COMMISSION DISCOUNT!

Stay updated with exclusive news, analytics, and on-chain data by following our

Telegram

and

Twitter

accounts!

Get Notifications from Comments Here

Report

Receive Notifications when a new reply is made to my comment

Label

Name:

Mail

Δ

Label

Name:

Mail

Δ

0

Comments

Inline Feedbacks

View all comments